How to track Job Time Costs for LLC members/owners that are not Employees? They are not on the payroll so they cannot enter time worked to jobs. But it is important to see how profitable the jobs are.

The idea here is to create a Zero-Journal bill to allocate time and effort to jobs without impacting on P&L report.

QuickBooks Setup (one-time)

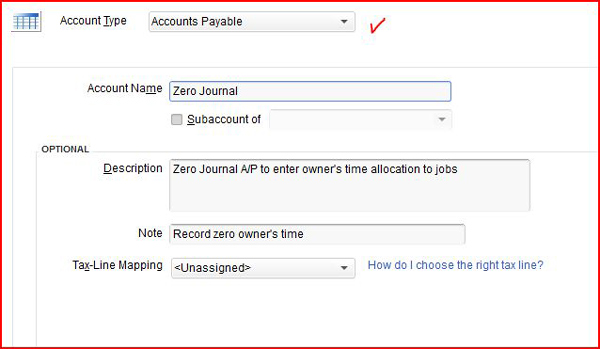

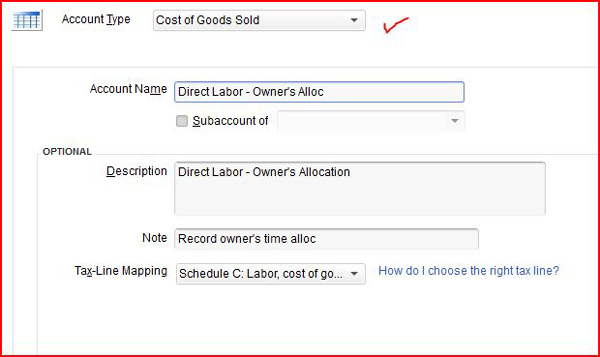

In your QuickBooks chart of accounts create the following new accounts:

GO to Lists menu > Chart of Accounts > Account > select New

- Zero Journal (under Accounts Payable – this is to differentiate this from operational Accounts Payable). Refer to Image # 1 for setup screen.

- Direct Labor – Owner’s Allocation (under COGS). Refer to Image # 2 for setup screen.

Image # 1

Image # 2

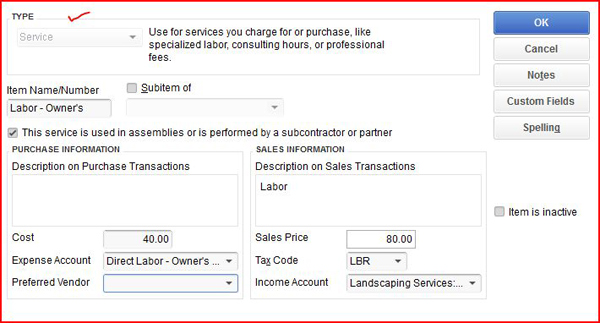

Service Item Setup

GO to Lists menu > Item List > Item > New > select Service

- Type = Service

- Item Name/Number = Labor – Owner’s

- Check the box > This service is used in assemblies or is performed by a subcontractor or partner

- Description = Leave it blank (if you put anything here, it will show up in job cost reports as lengthy unnecessary title/description)

- Sales = Labor (anything you like to see in your invoice as description)

- Cost = Hourly Rate (say $40 per hour for this example)

- Expense Account = Direct Labor – Owner’s Alloc (under COGS)

- Sales Price = Marked Up Hourly Billing Rate (say $80 for hour for this example)

- Tax Code = Non-Taxable Labor

- Income Account = Job Labor (title for income account)

- Refer to Image # 3 for setup screen.

Image # 3

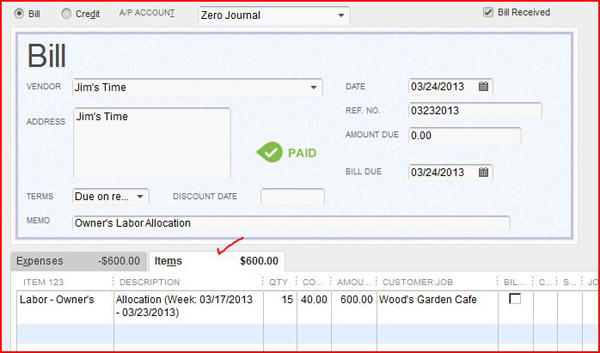

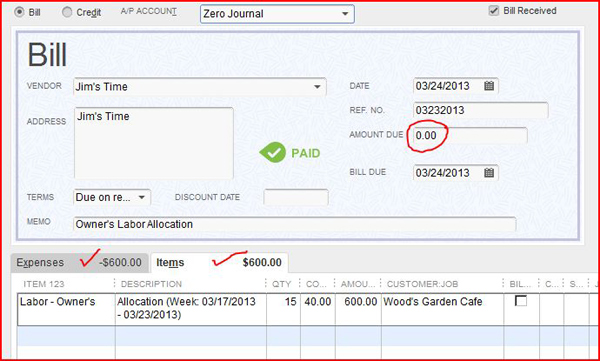

Enter Zero-Journal Bill for Owner’s Time Allocation

GO to Vendors menu and Select “Enter Bills”

- Have a Weekly (or Bi-Weekly) Timesheet ready

- Select Zero-Journal (NOT regular A/P)

- Vendors = Owner’s Name (setup as Other Name)

- Reference No. = Ending period of timesheet covered

- Select Items tab

- Select Labor = Owner’s from Item List (Service Type)

- Description = Timesheet work period

- Qty = Hours worked

- Cost and Amount should automatically calculate (hourly rate was already setup as $40 per hour in this example)

- Customer: Job = select Customer’s Name from Customer/Job

- Billable = check billable box if it’s actually billable to commercial customer (optional)

- Refer to Image # 4 for entry screen

Image # 4

- Select Expenses Tab

- Account = Direct Labor – Owner’s Alloc (COGS account type)

- Amount = Enter negative amount (in this example -600.00)

- Memo = Labor allocation – Owner’s Time

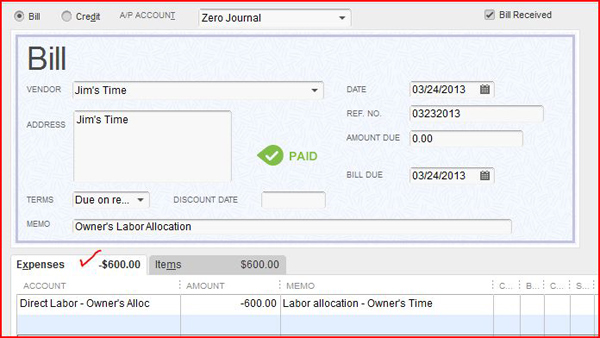

- Refer to Image # 5 for entry screen

- Notice Expenses Tab & Items Tab

- Should see negative amount (-$600.00 in this example) for Expense Tab

- Should see positive amount ($600.00 in this example) for Items Tab

- The net impact is zero journal entry with no impact to Profit & Loss account.

- Refer to Image # 6 for entry screen

Image # 5

Image # 6

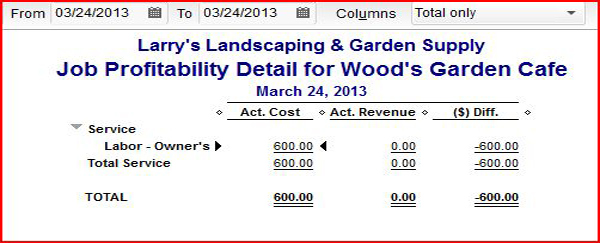

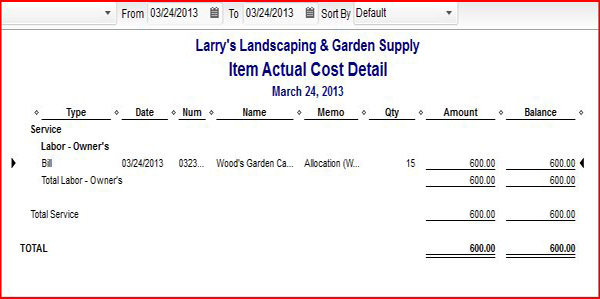

Now, let’s look at the various reports what will they turn out.

- Job Profitability Detail Report & Item Actual Cost Detail Report for this Job

- GO to Reports menu > Job, Time & Mileage > select Job Profitability Detail > select Customer

- Refer to Image # 7 for report screen

- Will reflect Owner’s cost of labor allocation for this job

- Double click actual cost dollar amount, it will take you to Item Actual Cost Detail Report. It will give detailed costs all the bill items entered for this job. Refer to Image # 8 for report screen

Image # 7

Image # 8

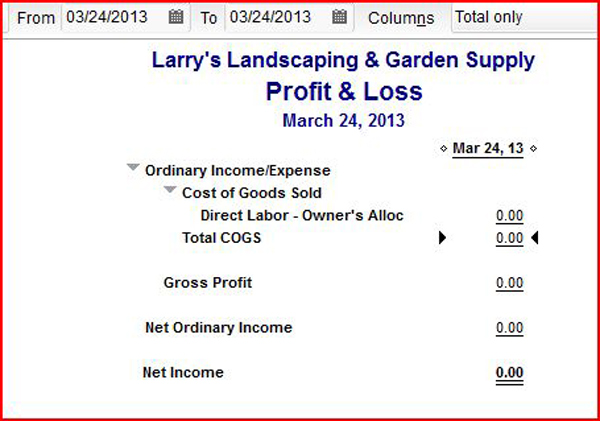

The big test is to see how it will come out in the Profit and Loss Report. See Image # 9 below. It shows no impact to P&L, and it zeroes out. It worked!

Image # 9

Please note that you should always run this past your CPA or Tax advisor to confirm it meets your needs, as we are not financial experts.